What is a Credit Sales Journal Entry and How to Record It?

When companies offer goods or services on credit, they often do so with stipulated conditions for the payment of the amount owed; these conditions are referred to as credit terms. The credit terms of purchases are usually indicated on the invoice of the purchase. It usually indicates when the amount owed is due for payment, any sales discount for the purchase as well as any applicable late payment fees or interest. In the income statement, the credit sales with discounts are immediately subtracted from the gross sales.

Sold Goods for Cash Journal Entry

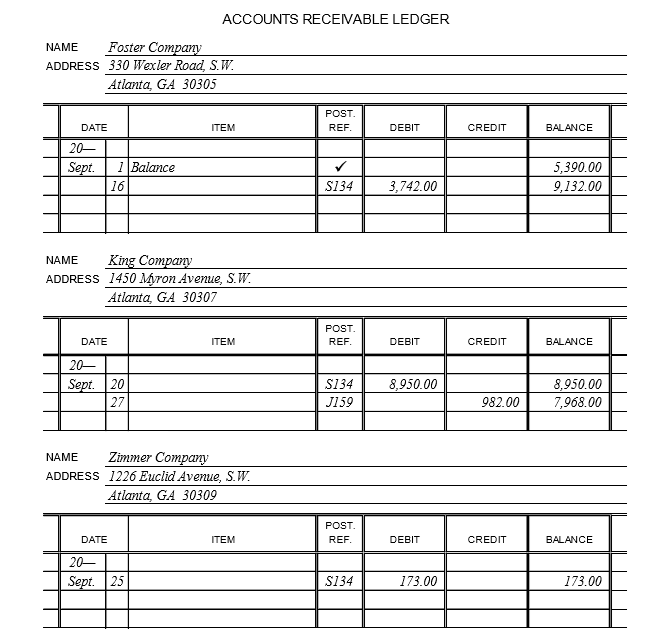

In other words, credit sales are purchases made by customers who do not render payment in full, in cash, at the time of purchase. The sales credit journal entry must have the sale date, the customer’s name, the sale amount, and the accounts receivable amount. The credit sales with credit sales journal entry discounts are directly deducted from the gross sales in the income statement. It means that the value of sales recorded in the income statement is the net of sales discount, cash, or trade discount. Little Electrodes, Inc. is a retailer that sells electronics and computer parts.

Credit Card Sales Received at a Later Date

A credit sales journal entry is a type of accounting entry that is used to record the sale of merchandise on credit. The entry is made by debiting the Accounts Receivable and crediting the Sales account. This type of journal entry is important because it allows businesses to keep track of their sales on credit and ensures that they are properly accounted for in the financial records. Without this type of entry, it could lead businesses to understate their income and overstate their expenses, leading to problems with tax compliance. Credit sales are recorded both on a company’s income statement and on its statement of financial position or balance sheet. On the income statement, it is recorded under revenue along with cash sales as sales.

How to show Credit Sales in Financial Statements?

An increase in credit sales shows that more customers are taking advantage of the credit sales that are offered by a company. Companies are careful when extending credit to customers since a failure to pay the amount owed adds to the company’s bad debt. Bad debt refers to all amounts owed to the company by its clients which are considered irrecoverable. Sales credit journal entries are also commonly used when businesses offer finance to customers. For example, let’s say you sell cars and offer customers the option of financing their purchase over three years.

- In a dynamic environment, credit sales are promoted to keep up with the cutting edge competition.

- This credit period is usually decided well in advance and can vary from industry to industry.

- Accrued revenue refers to a company’s revenue that has been earned through a sale that has already occurred, but the cash has not yet been received from the paying customer.

- We are now at the point in time where the customer wants to pay off some or all of their debt.

- It means John Electronics must make the payment on or before January 30, 2018.

Related AccountingTools Courses

This second journal entry would include a debit to Sales and a credit to Accounts Receivable. You’ll notice that the sales notebook only lists credit sales for inventories and products. As the debt owed has now been paid, we need to clear the £500 debit that was posted when the purchase was initially made. As the Accounts Receivable Account is an asset, we would decrease that asset by posting a credit for £500 – this effectively offsets the initial journal entry in the Accounts Receivable Account. Offering customers the option of a credit sale can bring a variety of benefits to businesses. Credit sales can be an attractive option for customers, who may not purchase without it.

Key Features of Sales Credit Journal Entry

This type of journal entry is often used by businesses that sell products on consignment or offer to finance to customers. A sales credit journal entry is a record of the sale of a product or service on credit. This type of journal entry is used to keep track of sales that have not been paid for in cash.

Although the process of recording credit sales might seem a bit daunting, constant practice of accurately recording it enhances one’s skill and makes it easier to handle. One important point to note when making the credit sales journal entry is that the amount debited and credited must be equal to ensure that the record is accurate and balanced. When utilizing credit sales as a payment option, businesses must manage their cash flow carefully in order to remain profitable. This is because credit sales involve customers paying for goods or services at a later date, either after a given amount of time or in multiple installments. This creates a situation where a business may have to wait until the customer pays for the goods or services before the business can receive the revenue. Businesses use the credit sales journal entry to keep track of credit sales which ensures that errors are avoided when trying to retrieve these debts and that the company’s financial statements are accurate.

Before the start of a financial or assessment period, the technique of documentation is established, and it is followed to prevent confusion in the organization’s recordkeeping system. When the goods are sold on credit to the buyer of the goods, the sales account will be credited to the company’s books of accounts. Therefore, it will increase the revenue and reflect in the company’s income statement during the sale period. Let us have a look at how the various credit sales journal entries are actually recorded during the course of the daily operations of companies.

Overall, credit sales can provide numerous benefits to businesses, including increased sales, better control over cash flow, and improved customer satisfaction. Businesses that offer credit sales can gain an advantage over those that do not, as customers may be more likely to make purchases with the added convenience of credit. At the end of each accounting period (usually monthly), the sales journal double entry is used to update the general ledger accounts.

Comments are closed.