How to Calculate the Contribution Margin Ratio

In order to calculate the contribution margin ratio, you’ll first need to calculate the contribution margin. The best contribution margin is 100%, so the closer the contribution margin is to 100%, the better. The higher the number, the better a company is at covering its overhead costs with money on hand. The contribution margin ratio is calculated as (Revenue – Variable Costs) / Revenue.

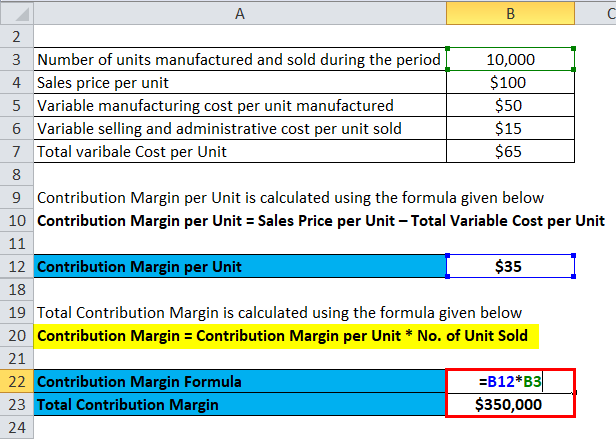

Calculate Contribution Margin in Excel (with excel template)

That means $130,000 of net sales, and the firm would be able to reach the break-even point. We will look at how contribution margin equation becomes useful in finding the break-even point. As of Year 0, the first year of our projections, our hypothetical company has the following financials. Accordingly, the net sales of Dobson Books Company during the previous year was $200,000. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

What is a Good Contribution Margin?

You may also look at the following articles to enhance your financial skills. The greater the contribution margin (CM) of each product, the more profitable the company is going to be, with more cash available to meet other expenses — all else being equal. The insights derived post-analysis can determine the optimal pricing per product based on the implied incremental impact that each potential adjustment could have on its growth profile and profitability. The benefit of expressing the contribution margin as a percentage is that it allows you to more easily compare which products are the most valuable to your business. Therefore, we will try to understand what is contribution margin, the contribution margin ratio, and how to find contribution margin. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

How do you calculate the weighted average contribution margin?

- This is if you need to evaluate your company’s future performance.

- The contribution margin ratio represents the marginal benefit of producing one more unit.

- At breakeven, variable and fixed costs are covered by the sales price, but no profit is generated.

- They also use this to forecast the profits of the budgeted production numbers after the prices have been set.

- The contribution margin ratio is the difference between a company’s sales and variable costs, expressed as a percentage.

In these examples, the contribution margin per unit was calculated in dollars per unit, but another way to calculate contribution margin is as a ratio (percentage). Variable costs fluctuate with the level of units produced and include expenses such as raw materials, packaging, and the labor used to produce each unit. The result of this calculation shows the part of sales revenue that is not consumed by variable costs and is available to satisfy fixed costs, also known as the contribution margin.

Once you have calculated the total variable cost, the next step is to calculate the contribution margin. The contribution margin is the difference between total sales revenue and the variable cost of producing a given level of output. As mentioned above, contribution margin refers to the difference between sales revenue and variable costs of producing goods or services.

What does the contribution margin tell us?

Thus, to arrive at the net sales of your business, you need to use the following formula. A good contribution margin is all relative, depending on the nature of the company, its expense structure, and whether the company is competitive independent with its business peers. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

For instance, direct material cost and direct labor cost are the costs that can be directly allocated with producing your goods. Conceptually, the contribution margin ratio reveals essential information about a manager’s ability to control costs. The contribution margin may also be expressed as a percentage of sales. When the contribution margin is expressed as a percentage of sales, it is called the contribution margin ratio or profit-volume ratio (P/V ratio). The concept of contribution margin is applicable at various levels of manufacturing, business segments, and products.

You might wonder why a company would trade variable costs for fixed costs. One reason might be to meet company goals, such as gaining market share. Other reasons include being a leader in the use of innovation and improving efficiencies. If a company uses the latest technology, such as online ordering and delivery, this may help the company attract a new type of customer or create loyalty with longstanding customers. In addition, although fixed costs are riskier because they exist regardless of the sales level, once those fixed costs are met, profits grow. All of these new trends result in changes in the composition of fixed and variable costs for a company and it is this composition that helps determine a company’s profit.

So when you make a product or deliver a service and deduct the variable cost of delivering the product, whatever revenue is leftover is the contribution margin. As another step, you can compute the cash breakeven point using cash-based variable costs and fixed costs. Compare the lines for determining accrual basis breakeven and cash breakeven on a graph showing different volume levels. Cost accountants, FP&A analysts, and the company’s management team should use the contribution margin formula. CM is used to measure product profitability, set selling prices, decide whether to introduce a new product, discontinue selling a product, or accept potential customer orders with non-standard pricing. Contribution margin is the remaining earnings that have not been taken up by variable costs and that can be used to cover fixed costs.

Comments are closed.