Debt-to-Equity D E Ratio Formula and How to Interpret It

Different industries vary in D/E ratios because some industries may have intensive capital compared to others. This could lead to financial difficulties if the company’s earnings start to decline especially because it has less equity to cushion the blow. There is no universally agreed upon “ideal” D/E ratio, though generally, investors want it to be 2 or lower.

What Is Debt-to-Equity-Ratio & How to Calculate It?

D/E ratios should always be considered on a relative basis compared to industry peers or to the same company at different points in time. A business that ignores debt financing entirely may be neglecting important growth opportunities. The benefit of debt capital is that it allows businesses to leverage a small amount of money into a much larger sum and repay it over time. This allows businesses to fund expansion projects more quickly than might otherwise be possible, theoretically increasing profits at an accelerated rate.

Create a Free Account and Ask Any Financial Question

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Current assets include cash, inventory, accounts receivable, and other current assets that can be liquidated or converted into cash in less than a year. Quick assets are those most liquid current assets that can quickly be converted into cash. These assets include cash and cash equivalents, marketable securities, and net accounts receivable.

Debt-to-Equity (D/E) Ratio Formula and How to Interpret It

A high ratio indicates that a company may be at risk of default on its loans if interest rates suddenly rise. A ratio below 1 means that a greater portion of a company’s assets is funded by equity. The debt-to-equity ratio (D/E) is a financial leverage ratio that can be helpful when attempting to understand a company’s economic health and if an investment is worthwhile or not. It is considered to be a gearing ratio that compares the owner’s equity or capital to debt, or funds borrowed by the company.

Debt to Equity Ratio Calculator (D/E)

- Some industries, such as banking, are known for having much higher debt-to-equity ratios than others.

- Investors may check it quarterly in line with financial reporting, while business owners might track it more regularly.

- The depository industry (banks and lenders) may have high debt-to-equity ratios.

- In contrast, industries like technology or services, which require less capital, tend to have lower D/E ratios.

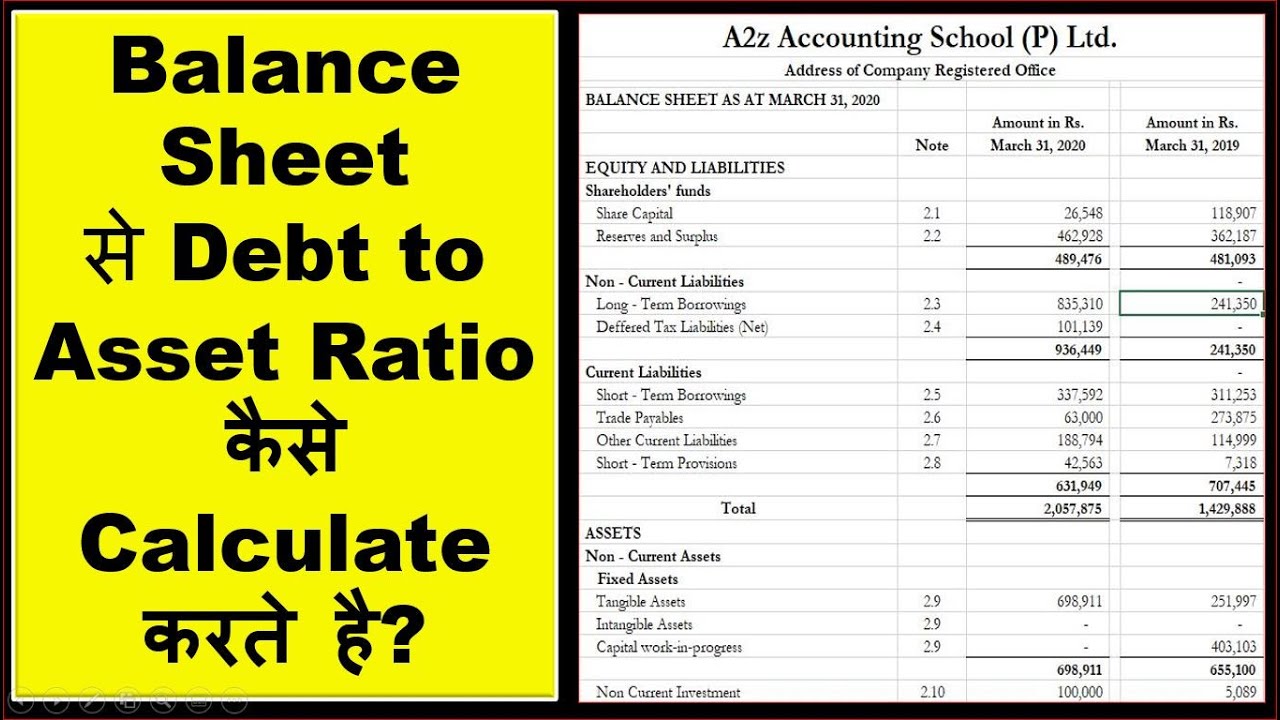

In other words, the debt-to-equity ratio shows how much debt, relative to stockholders’ equity, is used to finance the company’s assets. We have the debt to asset ratio calculator (especially useful for companies) and the debt to income ratio calculator (used for personal financial purposes). This debt to equity calculator helps you to calculate the debt-to-equity ratio, otherwise known as the D/E ratio.

Debt to Equity Ratio Calculation Example

Generally, a ratio below 1 is considered safer, while a ratio above 2 might indicate higher financial risk. Conversely, a low D/E ratio suggests that a company has ample shareholders’ equity, reducing the need to rely on debt for its operational needs. This indicates that the company is primarily financed through sales journal entry: cash and credit entries for both goods and services its own resources, reflecting strong financial stability and a lower risk profile. Companies can manage their Debt to Equity ratio by controlling debt levels and increasing equity through retained earnings or issuing new shares. Strategic management of this ratio is crucial for long-term financial health.

The debt-to-equity ratio belongs to a family of ratios that investors can use to help them evaluate companies. As a general rule of thumb, a good debt-to-equity ratio will equal about 1.0. However, the acceptable rate can vary by industry, and may depend on the overall economy. A higher debt-to-income ratio could be more risky in an economic downturn, for example, than during a boom. A company’s ability to cover its long-term obligations is more uncertain, and is subject to a variety of factors including interest rates (more on that below). The debt-to-equity ratio is most useful when used to compare direct competitors.

The debt ratio is defined as the ratio of total debt to total assets, expressed as a decimal or percentage. It can be interpreted as the proportion of a company’s assets that are financed by debt. Therefore, even if such companies have high debt-to-equity ratios, it doesn’t necessarily mean they are risky. For example, companies in the utility industry must borrow large sums of cash to purchase costly assets to maintain business operations. However, since they have high cash flows, paying off debt happens quickly and does not pose a huge risk to the company.

The debt-to-equity ratio is one of the most important financial ratios that companies use to assess their financial health. It provides insights into a company’s leverage, which is the amount of debt a company has relative to its equity. While acceptable D/E ratios vary by industry, investors can still use this ratio to identify companies in which they want to invest. First, however, it’s essential to understand the scope of the industry to fully grasp how the debt-to-equity ratio plays a role in assessing the company’s risk. But let’s say Company A has $2 million in long-term liabilities, and $500,000 in short-term liabilities, whereas Company B has $1.5 million in long-term debt and $1 million in short term debt.

Comments are closed.